A new tax-credit scholarship program passed by state lawmakers last summer to provide tuition funds to attend nonpublic schools could be making private school attendance possible for low-income students, a Morgan Park Academy spokesman said during a recent interview.

"Hopefully, students from low-income families will be able to afford a great education," Vincent Hermosilla, Morgan Park Academy's assistant head of school and community relations, told South Cook News. "We are one of the best private schools in Chicago and we have perhaps the most diverse student body."

The program is making possible what might have been impossible before for low-income families, Hermosilla said.

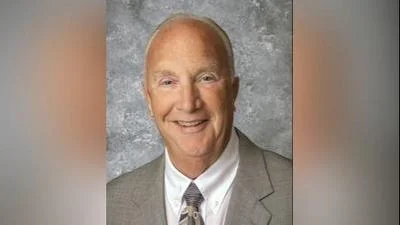

Illinois Gov. Bruce Rauner

"We think this program is an opportunity for low-income families to consider a private independent school education for their child in an enriching environment," he said.

The Invest in Kids Act, passed by the Illinois General Assembly last summer, includes provisions to award scholarships, invest in school infrastructure and provide tax relief to teachers who personally purchase supplies for their students. The act was part of the broad school funding agreement and was widely seen as a last minute concession to Republican lawmakers to get them to back the otherwise Democrat-driven omnibus bill.

The act made Illinois the 18th state in the nation to establish a tax-credit scholarship program to provide tuition money for students to attend nonpublic schools.

Under the act, taxpayers may contribute up to $1.3 million to eligible organizations. Contributors also can receive an income tax credit equal to 75 percent of their approved contributions with a state-enforced cap of $100 million in annual contributions.

The program attracted more than $36 million in pledged contributions on its first day, Jan. 2, according to a press release issued the following day by Republican Gov. Bruce Rauner.

"When we unleash the power of private-sector investment incentives like Invest in Kids, great things are possible," Rauner was quoted in the press release. "Within its first hour of going live, more than one-third of all Invest in Kids contributions have been allocated for the 2018 tax year. This outpouring of generosity is truly a testament to the many Illinoisans who believe in offering students and their families a choice in their education."

The "Invest in Kids Act" had a successful debut earlier this month and so far has taken in more than $40 million from donors, Empower Illinois Executive Director Myles X. Mendoza told the Prairie State Wire.

That generosity will mean a great deal to low-income students, Hermosilla said.

"The tax credit will make our tuition more affordable for low-income families," he said.

It translates into a win for students and donors, Hermosilla said.

"We think it will allow talented students who could not otherwise afford a private school education the chance to experience our great programs," he said. "It also allows our donors to support our institution while receiving a generous tax credit from the state."

Individuals and businesses who would like to contribute to the Invest in Kids Act program may apply to the Illinois Department of Revenue for a Contribution Authorization Certificate to make contributions to one of the approved scholarship granting organizations. The organizations provide scholarships for eligible students to attend qualified non-public schools in Illinois.

Alerts Sign-up

Alerts Sign-up