The Chicago-area Republican running against a three-term incumbent in the 35th House District paints a stark image of what will happen in Illinois if a proposed statewide 1 percent property tax were to see the light of day.

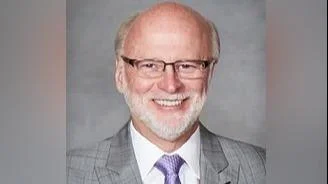

"No, I would not support a 1 percent property tax hike," Republican candidate Herbert Hebein of Mt. Greenwood told the South Cook News, adding that he knew what such a hike would mean for homes and families in his community.

"It would greatly increase their taxes and mortgages, and many may need to move out of state," Hebein said. "Owners would not improve their property. Some communities would be destroyed, areas would become dilapidated and left in ruins."

Hebein is vying for the House seat currently held by Rep. Frances Ann Hurley (D-Mt. Greenwood). Former aid to Chicago Aldermen Ginger Rugai and Matthew O'Shea, Hurley was first elected to the 35th District seat in 2012.

Hurley and Hebein both ran unopposed in the Democrat and Republican primaries in March.

The 35th House District is entirely in Cook County and includes the city of Palos Heights, townships of Orland and Palos, and villages of Alsip, Chicago Ridge, Merrionette Park, Oak Lawn, Orland Hills, Orland Park, Palos Park, Tinley Park and Worth.

Hebein's comments come a couple of weeks after a report issued by the Federal Reserve Bank of Chicago recommended spending down the state's enormous pension debt with a 1 percent statewide tax on residential property. The recommended tax would be in addition to property taxes - among the highest in the nation - that Illinoisan already pay.

"Because the debt is so large, it's unrealistic to think that new taxes (such as a tax on legalized marijuana or financial transactions) or increases that affect only a narrow segment of the population will be enough," the Chicago Fed said in its post that ran with the report. "Illinois will have to find additional revenues from already existing tax bases, either by increasing rates, expanding the definition of what is taxable, or a combination of the two."

In response, the Conservative Illinois Policy Institute pointed to an analysis by the nonpartisan Tax Foundation on the proposed tax.

"The results aren’t pretty," the Illinois Policy Institute reported, pointing to the foundation's analysis of Illinois as 45th in the nation for property tax burden at "2.03 percent of median income, or $2,087 per capita."

"If the Land of Lincoln implements this new 1 percent property tax, the Tax Foundation estimates Illinois' property tax burden would fall behind every other state, ranking 50 out of 50," the Illinois Policy Institute reported. "That ranking takes into account property tax collections per capita, property taxes as a percent of personal income and capital stock taxes."

Hebein lay the blame squarely upon Springfield lawmakers who prefer higher taxes to reforms.

"They are out of control with spending and big government," Hebein said. "Any politicians voting to raise our taxes again should be voted out."

The General Assembly should instead concentrate on reforms, Hebein said.

"They must cut spending and the budget by 10 percent with no new spending or programs until the financial situation is remedied," Hebein said.

Alerts Sign-up

Alerts Sign-up